tax avoidance vs tax evasion australia

Tax evasion vs tax avoidance. The major difference between tax avoidance and tax evasion is that the former is legal while the latter is illegal Murray 2017.

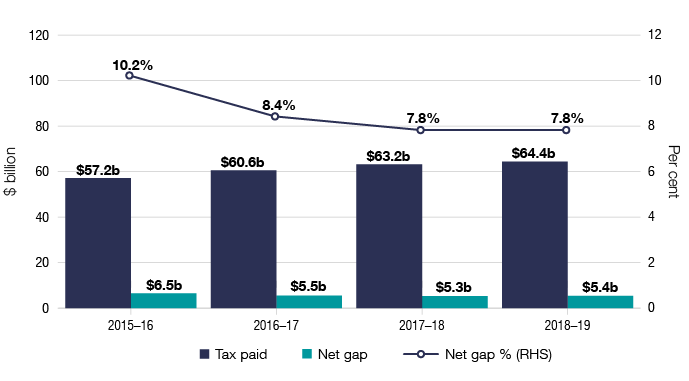

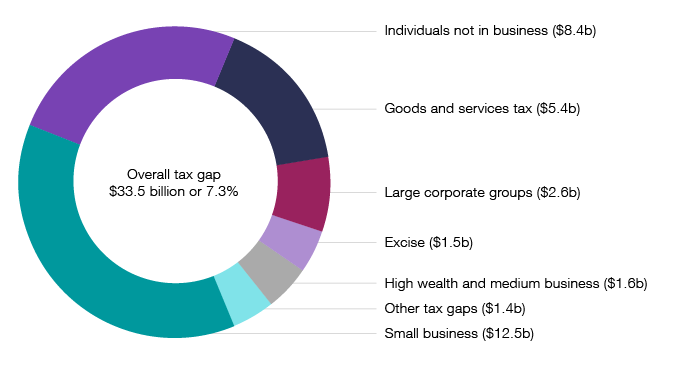

Tax Gap Program Summary Findings Australian Taxation Office

This article will first outline the difference between tax evasion and tax avoidance and then demonstrate the different investigation and.

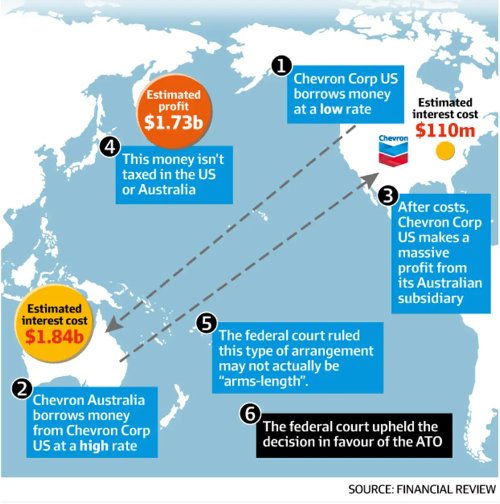

. While tax avoidance and tax evasion are both centred around avoiding paying taxes they are very different. While you get reduced taxes with tax avoidance tax evasion can result in fines penalties imprisonment or. Australia is leading the global fight against multinational tax avoidance and is cracking-down on taxpayer tax evasion with a number of reforms announced as part of the 2016-17 Budget.

The paper commences with a discussion on the distinction between tax avoidance and tax evasion in Australia and then critically examines the current approach of the. While tax evasion is illegal tax avoidance involves entering into legal arrangements that exploit loopholes or unintended defects in tax law. Excerpt from Essay.

However for some time the Australian Government. Australia is leading the global fight against multinational tax avoidance and is cracking-down on taxpayer tax evasion with a number of reforms announced as part of the 2016-17 Budget. TA 20205 Structured arrangements that provide imputation benefits on shares acquired where economic exposure is offset through use of derivative instruments.

In this case the tax advisor guides hisher clients based on the law regarding tax avoidance and tax. Tax avoidance vs tax evasion. While tax avoidance and tax evasion are both centred around avoiding paying taxes they are very different.

The paper commences with a discussion on the distinction between tax avoidance and tax evasion in Australia and then critically examines the current approach of the. While the two appear similar in meaning their characteristics penalties and administrative processes are quite different. Tax evasion and multinational tax avoidance Treasurygovau.

Sometimes taxpayers tax plans are right on the edge of tax evasion or tax avoidance. Tax non-compliance generally describes a range of activities that are unfavorable to a states tax system which include tax avoidance. What is the main difference between tax evasion and tax avoidance.

The distinction between tax evasion and tax avoidance to a great extent comes down to two components. Federal offences and tax evasion penalties. Tax avoidance is immoral that tends to bend the law.

Therefore tax avoidance means to reduce taxes by legal means whereas tax evasion refers to the criminal non-payment of tax liabilities. This short piece will also look at the Islamic view on this matter. Tax evasion is lying on your personal tax structure or some other structure says Beverly Hills California-based tax.

The distinction between tax avoidance and tax evasion has been well established in the Australian taxation system. TA 20211 Retail sale of illicit alcohol. The Diverted Profits Tax will reinforce Australias position as having amongst the toughest laws in the world to combat corporate tax avoidance.

Common tax avoidance arrangements. TA 20214 Structured arrangements that facilitate the avoidance of luxury car tax. To summarise tax avoidance is a legal and legitimate strategy while tax evasion is illegal and results in harsh punishments.

However for some time the Australian Government. The distinction between tax avoidance and tax evasion has been well established in the Australian taxation system. 61 02 8311 9993.

The main objective of a tax advisor is to assist hisher clients avoid taxes as much as possible through within the confines of the law in order to avoid crossing the line into tax evasion. The Australian government can prosecute tax evaders for committing offences under the Taxation Administration Act 1953 Cth. Tax avoidance is organizing your undertakings with the goal that you pay a minimal measure of tax due.

Tax Avoidance Confessions Of An International Tax Lawyer 2018

Tax Gap Program Summary Findings Australian Taxation Office

Tax Evasion And Tax Avoidance Explained Pdf Tax Avoidance And Tax Evasion Explained And Studocu

Tax Avoidance And Tax Evasion In 14 Itc Countries Ppt Download

Tax Avoidance And Tax Evasion In 14 Itc Countries Ppt Download

Chart The Global Cost Of Tax Avoidance Statista

Explainer The Difference Between Tax Avoidance And Evasion

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Evasion In The Oil And Gas Industry National Whistleblower Center

Tax Evasion The Budget Cost Prosper Australia

Explainer The Difference Between Tax Avoidance And Evasion

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Vs Tax Evasion Muslim Perspectives On The Ethics Of Tax Amust

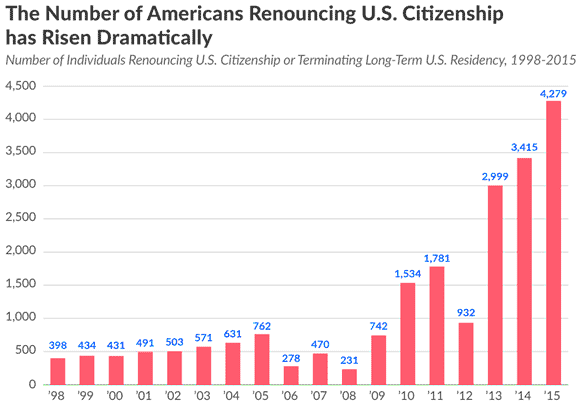

Tax Evasion Statistics 2022 Update Balancing Everything

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Differences Between Tax Evasion Tax Avoidance And Tax Planning